Investors,

Bitcoin is currently trading at all-time highs relative to U.S. Treasuries.

In fact, the apex digital asset just achieved its highest daily and weekly close ever vs. U.S. Treasuries on Friday. I bring this up for a few reasons:

From a traditional market perspective, this ratio is comparing a risk asset vs. a less risky asset. When a risk asset rises relative to a less risky asset, that’s typically a sign that we’re in a bull market, a risk-on environment, and even an economic expansion. Quite simply, it’s hard to imagine a risk-on & bull market environment when we’re in a recession, right? Because BTC is drastically outperforming Treasuries, this helps us to confirm that we aren’t in a recession, that we’re in a bull market, and that we’re in a risk-on environment.

Those who understand the fundamental value proposition of Bitcoin as a scarce asset believe, rightly so, that U.S. Treasuries represent the future promise of fiat and that fiat is not scarce because of the propensity of central banks to print money and for governments to run fiscal deficits. In other words, this chart is comparing scarcity vs. non-scarcity. For many Bitcoiners, their investment thesis is simply that the most scarce asset will outperform less scarce assets, and this chart is proving that they’re right.

If Treasuries represent the promise to receive future dollars (via coupon payments and re-payment of principal at maturity), one could argue that the BTC/TLT chart is foreshadowing where BTC/USD is headed in the coming months & quarters. As investors, we should be mentally prepared for new all-time highs in the price of Bitcoin denominated in U.S. dollars. I’m not saying that it’s guaranteed, but in a vacuum, this is what BTC bulls want to see in order to confirm that positive developments are taking place.

These conclusions are blatant facts, so it’s up to each of you to decide how it makes you feel…

• If the conclusions upset you, that doesn’t change their validity. They are truths.

• If the conclusions make you happy, then you’re likely on the right side of the trade.

• If you don’t feel any type of way, you’re doing a great job of being objective & open to acknowledging truth, regardless of how it’s impacting your portfolio/outlook.

I fall somewhere between the second & third category.

In the remainder of this edition of Cubic Analytics, I’ll analyze more of the top charts & datapoints from the latest week of market activity, highlighting the key trends & conclusions so that you’re able to have a firmer grasp on the economy, the stock market, and Bitcoin. As always, this report is 100% free and available to everyone!

If you’ve gotten any value at all from my research, consider sharing it or liking it!

As a side-note, I’m currently in Rome and will be here for another week, so please contact me if you happen to be here and I’d love to setup a time to meet!

Macroeconomics:

This week was full of new labor market data, confirming the same thing I’ve been saying for the past 18 months:

The labor market is resilient & dynamic.

Again, that’s just a fact.

Are there aspects that are weak? Yes.

Are there aspects that are softening? Yes.

Are there aspects that are improving? Yes.

Are there aspects that are outright strong? Yes.

Is the all-encompassing labor market perfect? No.

Regarding this final point, there has never been a labor market that’s perfect in the history of economics, not just the U.S. labor market. If you know of one that was absent of any soft spots, areas of weakness, or points of contention, let me know…

The simple truth is that bears & Doomers will rotate from one point of weakness to the next, so long as it fits there narrative about an impending collapse or even the asinine claim that we’re currently in a recession right now.

And to be fair, perma-bulls do the same thing.

Hopefully, my objective review of the data and willingness to change my mind provides some degree of credibility on this topic, as I think I’ve done a solid job of being consistent in my approach to diagnosing the state of economic affairs.

With that said, these are the charts & datapoints that I want you to know about:

1. Using the number of job-openings from the October JOLTS data to understand the implications for inflation dynamics:

The JOLTS data came in softer than expected, aligned with my own personal belief that the labor market will remain resilient but likely soften into the months & quarters ahead. Job openings at the end of October were 8.733M vs. the expectation of 9.4M and prior results of 9.4M. To be clear, 8.733M is still an enormous amount of job openings relative to history and prior non-recessionary periods! So why is this important for inflation dynamics? Because there’s a solid correlation between job openings and the rate of core inflation on a YoY basis, for both CPI & PCE:

Is it a perfect correlation every single month? No, but it’s pretty damn good at tracking long-term dynamics — we should expect to see inflation accelerate as job openings increase & we should inversely expect to see inflation decelerate as job openings decrease. As such, the ongoing decline in job openings is further confirmation of my disinflationary outlook as we go into 2024.

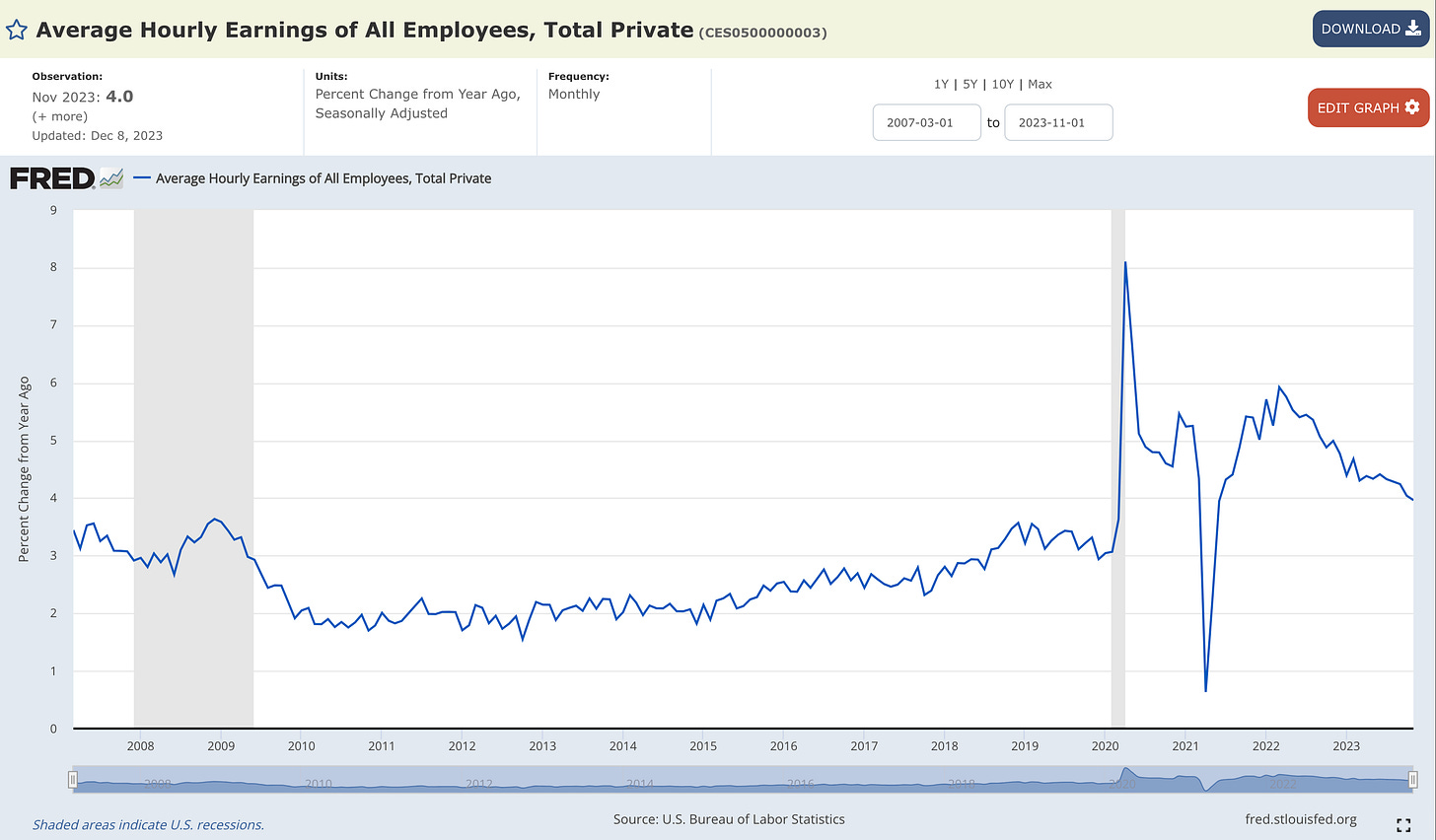

2. Wage growth is still high, but decelerating back towards the historic range:

Per the nonfarm payrolls (NFP) data for November, published on Friday, we have further evidence that nominal wages are still rising, but the nominal rate of wage growth continues to decelerate.

At a +4.0% YoY growth rate, wage growth has exceeded that rate of CPI inflation for 6 consecutive months. Once the November CPI data is published this coming Tuesday, we’ll have an opportunity to extend the streak to 7 consecutive months. In other words, on a YoY basis, U.S. employees have experienced real wage growth (nominal wage growth less inflation) for nearly half a year. That’s a small win, but an important one to acknowledge. Furthermore, as wage growth continues to decelerate (which I think is likely), it will likely create even more disinflation.

3. Understanding the relationship between the unemployment rate and the labor force participation rate:

From the same NFP report for November 2023, the BLS data shows that the unemployment rate declined to 3.7% from 3.9% in the prior month. First of all, it’s important to recognize that this doesn’t happen during a recession. Second of all, it’s important to contextualize this decline in the unemployment rate relative to the degree of labor force participation.

In the NFP data, we saw the labor force participation rate rise to 62.8% from 62.7% while the prime-age labor force participation rate (specifically focusing on those aged 25-54) was unchanged at 83.3%.

The labor force participation rate (LFPR) measures the percentage of the population who is qualified to work, defined as individuals aged 16 and older, who are either actively employed or actively seeking employment. This latter cohort, those who are seeking employment, are formally classified as unemployed. Therefore, the labor force participation rate is the key metric for evaluating the health and size of the overall labor force because it encapsulates both statuses of the employed and unemployed.

This raises an important correlation between the LFPR and the unemployment rate!

Because the LFPR includes those who are formally considered to be unemployed, a rise in the LFPR should (all else being equal) cause the unemployment rate to rise! Therefore, when the LFPR and unemployment rate deviate in this manner, as they did in November, it’s a key sign that the labor market is extremely resilient because the market “absorbed” the larger labor force and saw a decline in the unemployment rate.

This helps us to further validate the resilient & dynamic nature of the labor market.

4. Firing activity is historically low:

I’ve been highlighting this all year, but it’s worth repeating once again that employers are still hoarding their workforce. Specifically, we can look at the layoffs rate, which remains at all-time lows. In other words, despite what Doomers want you to think about the nominal level of weekly initial unemployment claims, the amount of people getting fired relative to the overall size of the labor force remains at all-time lows.

5. The amount of part-time workers is also low, when measured on a relative basis:

Many folks want to highlight that the number of part-time jobs is on the rise, trying to imply that people are so desperate for employment and income that they are forced to work multiple jobs in order to survive. While there is some validity to those claims, it’s being blown out of proportions for one simple fact:

Those who raise this concern are only focused on the total number of part-time jobs rather than measuring the relative number vs. the total amount of all jobs within the economy.

Why is this important? Because the job market is growing, we should expect that the number of part-time jobs is also growing!

As an analogy, as the size of the pie grows, the individual slices will also grow!

Therefore, when we measure the amount of multiple jobholders as a percentage of the total amount of people who are employed, we see see two things:

This variable has steadily been declining for 20+ years.

This variable decreased in November, falling from 5.2% to 5.1%.

As far as I’m concerned, there’s nothing to be overly concerned about with respect to part-time workers or the amount of people who are working multiple jobs.

In conclusion, it’s clear as day that the labor market remains both resilient & dynamic.

Stock Market:

I won’t dive into them further in this report, but there are four posts on X that you need to see and have on your radar:

1. Global liquidity cycles & asset prices, from

2. The S&P 500 is basically at ATH’s on a total return basis, from Bespoke.

3. If only 7 stocks were rising, as bears say, why is the German stock market hitting new all-time highs? Because more than 7 stocks are rising. From J.C. Parets.

4. On a relative basis, the more risky stock market sectors are outperforming their less risky counterparts, which happens during uptrends. From J.C. Parets.

I think these charts speak for themselves, so I’d strongly encourage you to take a quick look at each of them and to follow each account on X, as they all post excellent & top-notch research.

Bitcoin:

Altcoins & the broader cryptocurrency universe are hitting new YTD highs this week, consistent with the strength that we’re seeing in both Bitcoin & Ethereum in 2023.

On this point, I want to acknowledge three things:

1. While altcoins are participating in the rally, Bitcoin dominance also hit new YTD highs this week and then started to decline during the 2nd half of the week.

2. We can take this a step further by combining the Bitcoin dominance with Ethereum dominance (BTC.D + ETH.D), which also hit new YTD highs this week.

Currently measured at 71.1%, the implication is that stablecoins + altcoins make up the remaining 28.9% of the total cryptocurrency market cap, roughly the equivalent of $462Bn. With USDT + USDC, the two largest stablecoins, having a combined market cap of ~$115Bn, the altcoin universe has an approximate market cap of $347Bn.

This chart above looks like a false breakout, which implies that BTC.D + ETH.D are going to fall further to the recent pivot lows, perhaps sub-69%, which means that altcoins are likely to bid in this environment.

3. To confirm the conclusion above that altcoins are likely to bid in this environment, we need simply to analyze the performance of altcoins! Thankfully, we can do this with $TOTAL.3 - USDT - USDC:

Not only is $TOTAL.3 (ex-stablecoins) breaking out of key structure this week, price action continues to confirm the 52-week Williams%R momentum thrust into overbought territory. Why 52 weeks? Because it’s the equivalent of 1 year!

The last time this signal occurred was in July 2020 at the onset of the bull market. The most recent signal flashed in early November and we’ve only seen momentum increase since then!

Now that TOTAL.3 is breaking out above the horizontal red range (and the descending trendline that I also outlined in real-time), the entire range is now valid potential support if we have a retest in the weeks/months/quarters ahead.

In conclusion, it’s hard not to be bullish right now.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, & timeframes expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

"Hopefully, my objective review of the data and willingness to change my mind provides some degree of credibility on this topic."

That statement is positively critical to being an analyst.

Permabulls and permabears are infuriating - when the trend goes their direction, it makes people believe them for the long term. However, when the trend works against them, their "analysis" is simply conjecture and worthless, causing any of their followers to LOSE money and/or miss out on huge buying opportunities.

The industry is filled with novices who will accuse analysts who change their perspective as "flip-floppers."

People, the markets go up and down. If you're not changing your perspective, you're doing trading, investing, and, most likely, even your life, wrong.

"When the facts change, I change my mind. What do you do, sir?"

Thanks for another great post, Caleb!