Another One Bites The Dust

Investors,

My theory of the Earthquake Effect is still underway, with the newly announced shutdown of First Republic Bank on Friday. For the readers who have joined the Cubic Analytics team in the recent months, the Earthquake Effect is something that I coined in the aftermath of the FTX debacle in November 2022. Essentially, the theory is an analogy to describe the current economic environment through the events of a coastal earthquake, wherein an earthquake is followed by a massive tsunami:

Earthquake = inflation

Tectonic plate displacement = Federal Reserve rate hikes & B/S reduction

Receding water = tighter financial conditions & declining liquidity

Naked swimmers = leveraged investors, scams/frauds, malinvestments

Tsunami = recession, financial crisis, market failures, bankruptcies

First Republic has now overtaken the collapse of Silicon Valley Bank as the 2nd largest bank failure in U.S. history. In other words, we’ve just witnessed three of the four largest shutdowns in U.S. banking history:

Washington Mutual: $307 billion of assets in Sept’08 (or $424Bn in today’s dollars)

First Republic Bank: $233 billion of assets in April’23

Silicon Valley Bank: $209Bn of assets in Mar’23

Signature Bank of New York: $118Bn of assets in Mar’23

When I first shared the Earthquake Effect in November, I said the following:

“We’re seeing cracks across the crypto ecosystem, which could be foreshadowing further cracks in the traditional financial system. Even if these contagion events stay contained within crypto, it’s very possible that more dominoes are due to fall… However, as the tide goes out, we don’t know who will be exposed or how severe of an impact it will have on the broader market.”

I reiterated this perspective in my 2023 outlook, which evolved around the Earthquake Effect, by acknowledging that more mayhem was around the corner this year.

“Even if the magnitude and pace of rate hikes decelerates, which appears likely, higher real rates will tighten financial conditions and reduce liquidity. The longer they remain elevated, the more liquidity will decline. The combined effect of real rates that are higher for longer and the simultaneous reduction of the Fed’s balance sheet will apply pressure on the financial system and the economy. On net, this means that liquidity will continue to recede, potentially exposing more naked swimmers and creating an avalanche of fundamental economic pressure.”

The fact of the matter is that we don’t know who is next or what the magnitude of their unveiling will be. All I knew (and still believe) is that more failures would arise, with a growing threat to the fundamental economy & financial system.

There were concerns around the FRC in mid-March, which seemed to subside after a liquidity injection from JPMorgan Chase and Morgan Stanley. Traders and investors started to speculate on Twitter that the stock was extremely undervalued and worth buying. My response was simple: why take the risk?

I won’t dedicate this newsletter to a discussion/update on the Earthquake Effect, but I think this is an important reminder for investors to have. If you’d like to read the latest deep-dive I did on this topic after the collapse of SVB, you can read this report:

Macroeconomics:

Aside from the demise of FRC, which is still an unwinding story, we received important data for Q1 2023 real GDP growth, inflation dynamics, the housing market, and measures of economic activity.

On the aggregate, these datapoints are confirming that the U.S. economy is moderating & slowing down, with continued signs for concern.

While real GDP growth in Q1’23 was still positive, the result of +1.1% annualized was lower than the annualized growth rate of +2.6% in Q4 2022, which was also lower than the Q3 2022 figure of +3.2%. The latest figures are neither positive or negative, simply reflecting that the U.S. economy is growing, but at a relatively slower (and decelerating) pace. Considering that estimates were projecting for an annualized growth rate of +2.0% in Q1’23, this was a significant miss.

Personally, I’m not a fan of annualizing growth rates because it implies that growth is constant, which it isn’t. Measuring the quarter-over-quarter growth then compounding it 4x to get the annualized growth rate seems like a flaw in measuring growth. While I understand that seasonal adjustments are important, I find that the YoY rate of change in real GDP is be more telling than the annualized measure because it tracks the full story of economic activity (TTM) vs. one-quarter of activity.

The YoY growth of real GDP was faster in Q1 2023 than it was in Q4 2022, increasing from +0.88% to +1.6% YoY.

We can see that this YoY measure has been decelerating since Q2 2021, when the YoY comparison was benchmarked to the trough of economic activity during COVID; however, growth appears to be “below-trend” relative to the past 50 years of data.

The Personal Consumption Expenditures data was also released, providing insight to the Federal Reserve’s preferred method of measuring inflation. The YoY rate of change for March 2023 was +4.2%, down considerably from February’s result of +5.1% and January’s +5.4%. On the aggregate, this measure reaffirms the takeaways I’ve been sharing about CPI and PPI: we are firmly within a disinflationary environment.

To be clear, this doesn’t mean that prices are falling! It simply means that the rate with which prices are rising is slowing down. Think of a car traveling 100mph on the freeway and slowing to 65mph… the car is still moving forward (aka prices are rising), but the driver is now operating within the speed limit. Unfortunately, the Fed can’t be pleased with the current levels of inflation, though I believe that they should find comfort in the fact that it’s decelerating. In the car analogy, the Fed has slowed the speed down to 80mph and still has to bring the speed lower to 65mph.

However, they have their foot firmly on the brakes and I believe that they should instead be letting the car idle — not pressing on the brakes nor the gas pedal. The car will naturally slow due to the impact of friction, eventually bringing the car to the legal speed limit. At the current pace, I believe that the Fed is on track to slow the car to 40mph, which likely means that it will get rear-ended and cause an accident.

Of note regarding PCE inflation, median PCE inflation (orange) continues to remain elevated while core & headline figures are firmly decelerating.

This might be cause for concern, though I believe that housing market dynamics are influencing this figure to a significant degree, which are going to subside very shortly.

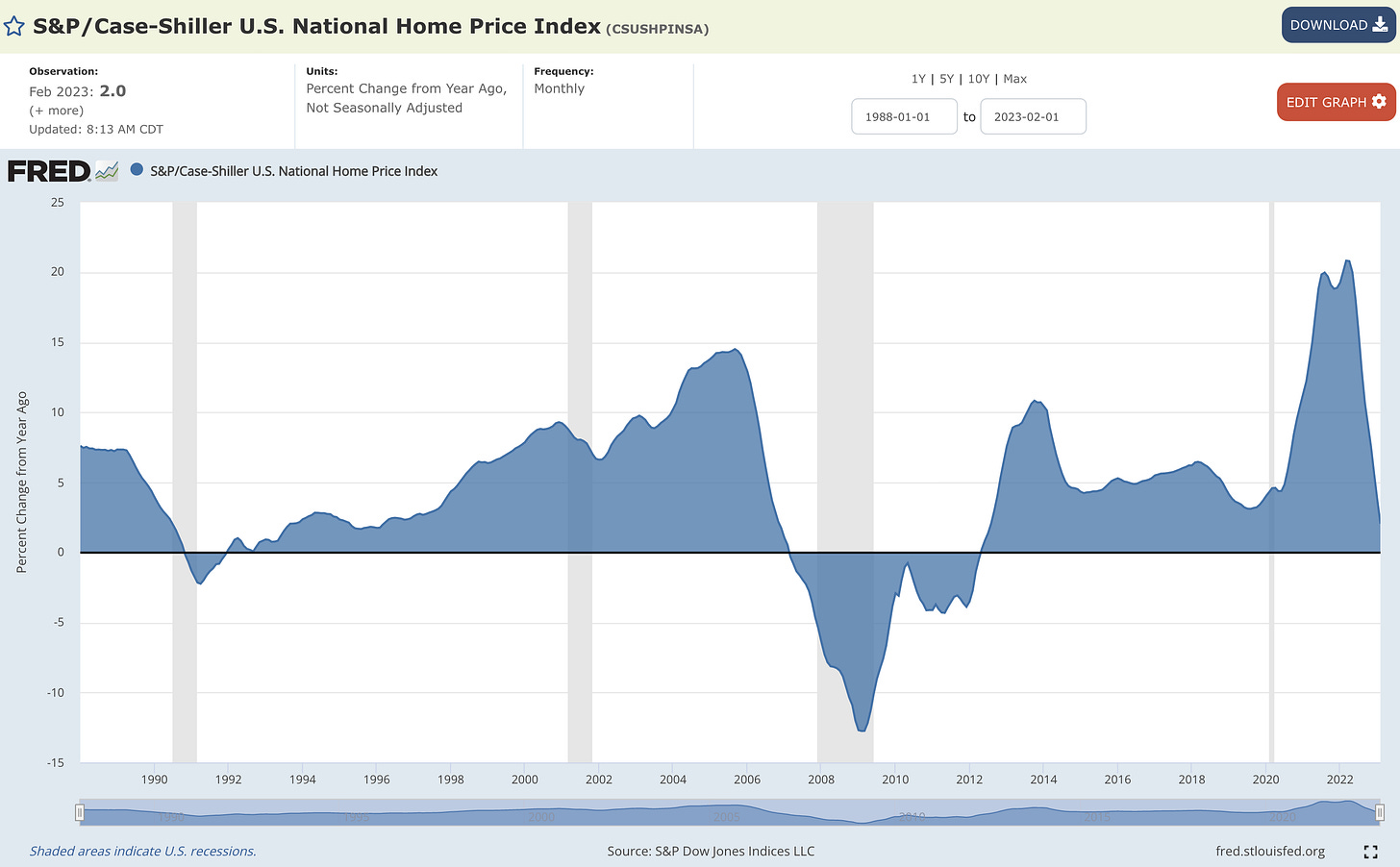

Speaking of housing, the latest data for the S&P Case-Shiller National Home Price Index was published for February 2023, which reflected a further YoY deceleration to +2.0% relative to Feb’22 vs. +3.75% in January 2023.

Since the index peaked in June 2022, the National Home Price Index has fallen by a modest -4.9% through February 2023. With mortgage rates elevated in the mid-6% range, my expectation is that housing market activity will continue to be strained and home prices themselves will steadily decelerate & outright decline in the months ahead. Keep in mind, the YoY growth rate peaked in March 2022 at +20.8%! We have clear evidence that this deceleration has been underway for the past year.

I focused heavily on manufacturing data in last week’s edition of Cubic Analytics, which generally reflected mixed signals between the Empire State data vs. the Philly Fed data. This week, new data from the Kansas City Federal Reserve was published about the manufacturing sector of the U.S. economy:

The result was an abysmal -10.0 vs. estimates of -2.0 and prior result of 0.0, reflecting a severe disappointment for the data. The conclusion is clear: manufacturing, which comprises a much smaller portion of the U.S. economy relative to the service sector, is contracting at an accelerated pace.

Of note, the employment component of the index contracted for the first time since June 2020, which is shown below alongside the new orders component.

We should expect to see a further deceleration & contraction in aggregate economic data in the months ahead, with growing momentum for weakness.

Stock Market:

Amidst a surprisingly strong earnings season, we’re seeing continued outperformance from market-cap weighting vs. equal-cap weighting. In other words, the largest stocks have been the strongest so far in 2023, and the largest stocks are predominantly the mega-cap tech names that we’re all familiar with.

We can measure this trend and ongoing outperformance in two distinct ways:

1. The NYSE FANG+ Index vs. the Equal-Cap S&P 500 ETF (NYFANG/RSP):

We’ve seen this ratio skyrocket at a phenomenal pace since in 2023, reflecting the extreme market dynamics at play. You’ll notice that the recent consolidation for the past few weeks is very reminiscent of the brief stagnation in the month of February before the next acceleration higher. Personally, I think there’s room for mega-cap tech and FANG stocks to continue their outperformance.

I continue to be excited about my recent partnership with MicroSectors and their REX Shares team, who created the FNGU and FNGD products to create both direct and inverse exposure to the NYSE FANG+ Index.

If you haven’t already, I’d encourage you to research their products and follow them on Twitter for updates. As an aside, I recently started a position in one of their ETN’s, GDXD, which is the 3x inverse gold miners ETN! I personally feel that gold and gold-related stocks are going to face downward pressure in this market, so this is one of the most exciting ways for me to benefit from my thesis.

Personally, I may be looking to take a short-term trade on FNGU 0.00%↑ this upcoming week in the event that there's a market pullback that provides an attractive entry into the trade. We saw strong reports for Microsoft, Google, Meta, and Amazon this past week, with Apple reporting this upcoming week. At the end of the day, I've been a believer that tech will show leadership in this market environment precisely because of the ongoing bank failures.

Recall, a few days after the shutdown of SVB, I published the following:

Since then, here are the returns for the indexes:

Dow Jones $DJX: +7.15%

S&P 500 $SPX: +8.75%

Nasdaq-100 $NDX: +12.75%

NYSE FANG+ Index $NYFANG: +15.8%

Tech, and mega-cap tech in particular, is outperforming everything else. While this could change in the weeks/months ahead, I think that crazy trends can remain crazy.

Despite concerns about FRC during Friday’s trading session, while the bank’s stock was down -43% on the day, the Nasdaq-100 closed the session up +0.65% and NYFANG gained +0.49%.

2. The S&P 500 vs. the Russell 2000 (SPX/RUT):

This captures large-cap stocks relative to small-cap stocks, providing a key insight to the general risk appetite of investors, on the aggregate. The ratio is rapidly approaching the all-time high from Q1 2020, once again highlighting the extreme nature of current market dynamics. We can notice that this ratio’s acceleration lagged the NYFANG/RSP relationship, only starting its recent uptrend in Mach 2023, exactly when the bank failures came into the market!

The takeaway here is roughly the same as NYFANG/RSP, showing how investors are increasing their demand for large-cap companies by a much larger degree than small-caps, which are more volatile and uncertain.

I certainly don’t know what’s around the corner for the market, but there are three primary views that I have about the market right now:

The market can stay irrational longer than I can stay solvent. Therefore, betting against the irrationality in the short-term is a brutal endeavor.

While the music is playing, you have to dance. Stocks and crypto have been performing extremely well this year, despite the ongoing headwinds in macro and the potential risks that lay ahead. While those risks are serious, the market is fully aware of them and is still pushing higher. As a trader, I don’t want to fight the tape. As an investor, I’ll continue to be patient and steadily increase my ownership of long-term, high-conviction assets that I plan to hold.

Aware of these fundamental risks and the potential market downside, I’ll be nimble in my positions & be willing to accept that my thesis was incorrect.

Bitcoin:

As I alluded to last week, I did purchase Bitcoin on Sunday and again on Monday. As a portion of the capital that was allocated, I bought 67% worth of Bitcoin and 33% worth of Ethereum. This will likely be my allocation decision going forward, on every -10% decline for Bitcoin henceforth, though I certainly reserve the right to make changes.

Bitcoin nearly reached $30k earlier in the week, but faced slight selling pressure from a relatively random catalyst. Early reports indicated that the U.S. government and Mt. Gox were selling their BTC, but later reports seemed to refute this suggestion and crypto has inched higher since the initial selloff. At the time of writing, BTC is consolidating above $29.3k while ETH is trading precisely at $1,900.

With minimal market-moving information for crypto, I thought it would be useful to zoom out and focus specifically on the Bitcoin halving event that will take place in roughly 12 months. On this topic, there are two fantastic charts from The Rational Root that I wanted to share:

1. Bitcoin is ~75% of the way between the past and future halving event:

This has been a key milestone within the Bitcoin cycle, typically indicating that the end of the bear market is over as investors begin to price-in the upcoming halving event roughly 12 months away. As simple economics states, when the supply of a good or service becomes less available (aka more scarce), the price of that good/service will rise, all else being equal. However, all else is not equal given that the adoption and underlying demand for Bitcoin has been rising. As such, upward price pressures are likely to accelerate in an environment where supply is becoming increasingly scarce and demand is increasing.

2. Bitcoin halving clock:

Another way to view Bitcoin cycles is this beautiful spiral analysis by Root, measuring the outward growth of Bitcoin’s price relative to the blocks (an alternative measure of time) on the network. As new blocks get verified, implying the continued success of decentralized verifications, the value of the Bitcoin network will continue to rise over time. We can see that Bitcoin bottoms typically occur around the 7:30 time of the clock (131.25k blocks), which is now in the rearview mirror. While this doesn’t mean that the lows are certainly in, I do believe that there’s a strong likelihood that the lows are in.

In other words, new cycle lows are possible, but I don’t think they’re probable.

Best,

Caleb Franzen

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

This report may not be copied, reproduced, republished or posted without the consent of Cubic Analytics and/or Caleb Franzen, without proper citation.

Please be advised that this report contains a third party paid advertisement and links to third party websites. These advertisements do not constitute endorsements and are not necessarily representative of the views or opinions of the newsletter author. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.