A New Accumulation Signal

Investors,

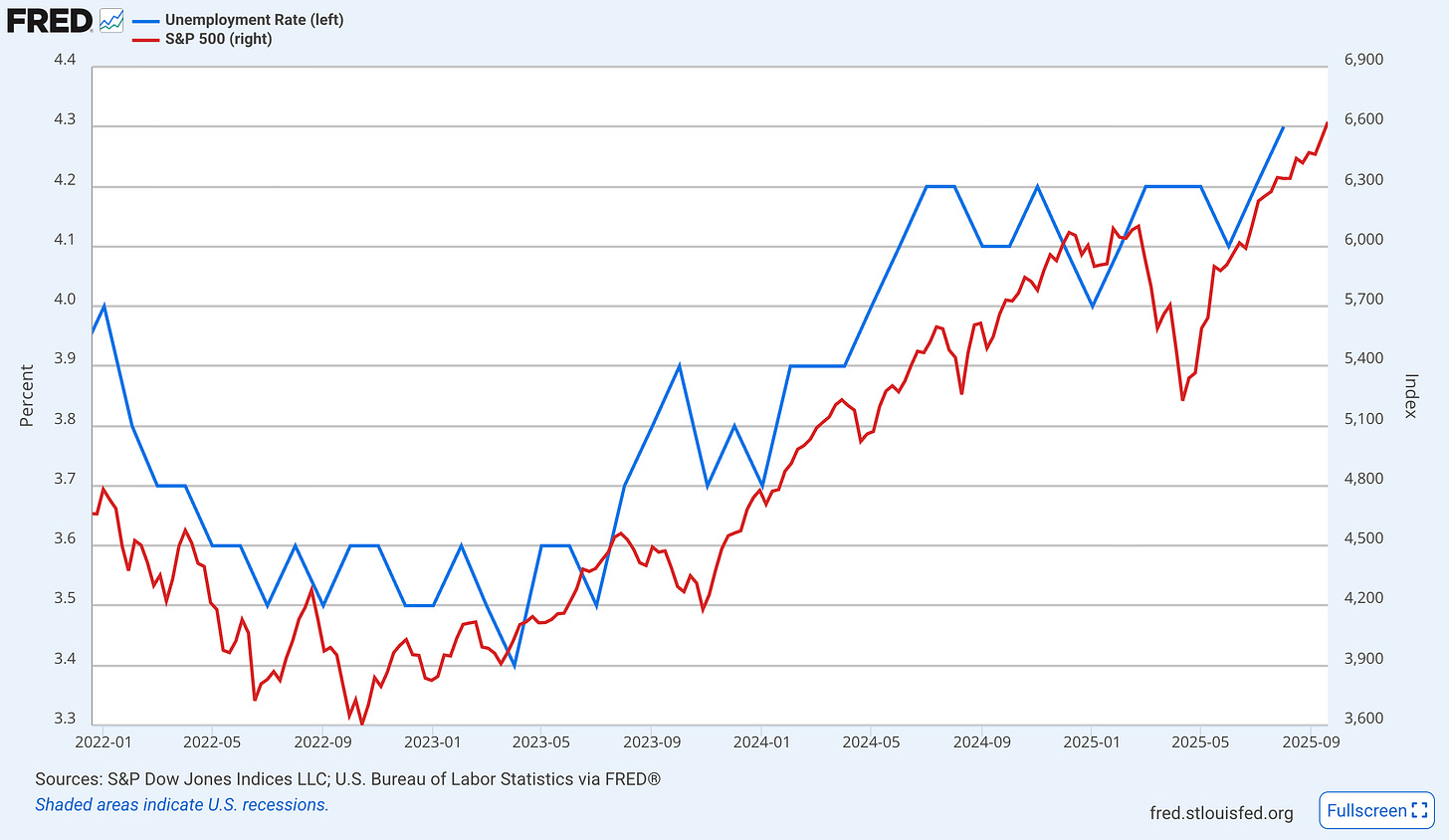

The conclusion from yesterday’s free report was that labor market softness, while still being resilient & dynamic, has been a major factor to support the ongoing bull market.

I proved that point in one simple chart, looking at the correlation between:

🔵 The U.S. unemployment rate

🔴 The S&P 500 ($SPY)

At some point, we should expect there to be a “breaking point” where this correlation will cease to continue, meaning that there is a higher unemployment level where stocks will not rally.

But what will that level of unemployment be? That’s anyone’s guess.

One of the beautiful aspects of finding correlations like this is that we know to pay attention when the correlation stops.

In other words, once these datapoints diverge, that’s signal.

While yesterday’s report focused on big-picture dynamics in the labor market and why it’s relevant for investors, today’s premium report will focus exclusively on the stock market and crypto.

I’ve seen a tremendous amount of nonsense on social media, from affiliate link shills who are trying to go viral at any expense. These “influencers” (because they certainly aren’t “analysts”) have one goal: to go viral with fear-based headlines & lazy research.

If you’re following me on X, you know exactly what (and who) I’m talking about.

Unfortunately, these methods aren’t new and they aren’t contained to a few people.

They are widespread.

At the end of the day, I can’t combat and debunk these narratives myself.

Thankfully, through my 11+ years of dedication to the market, plus my professional experience in wealth management and banking, I know how to debunk these charts and to ignore them because I’ve done the work.

In addition to analyzing current market conditions so that we can make more informed investment decisions, the purpose of these premium reports is to highlight the actual tools, strategies, and indicators that I’ve found effective in my 11 years as an investor.

You can take those methods, alter them, and apply them to whatever asset you want.

That’s the two-pronged benefit of Cubic Analytics:

You get my current, exclusive, and original analysis on the market.

You learn how I use various tool, strategies, and indicators for your own work.

Let’s begin with this latest edition…

In total, this report contains 17 exclusive charts that I haven’t shared anywhere else.