Investors,

The stock market continues to roar back after headline overreactions about an imminent recession and the unwind of the Yen Carry Trade.

Fortunately, Cubic Analytics members were notified of clear oversold signals in the S&P 500 going into the market open on August 5th, which were identified as bullish opportunities for both short and long-term investors.

Since the lows on August 5th, the S&P 500 has rallied +8.6% and the Nasdaq-100 has gained roughly +12%.

I also shared another bullish volatility indicator on August 12th, which has major implications for long-term investors, which you can access here on X.

Today, I’m going to tell you about another important signal that just flashed.

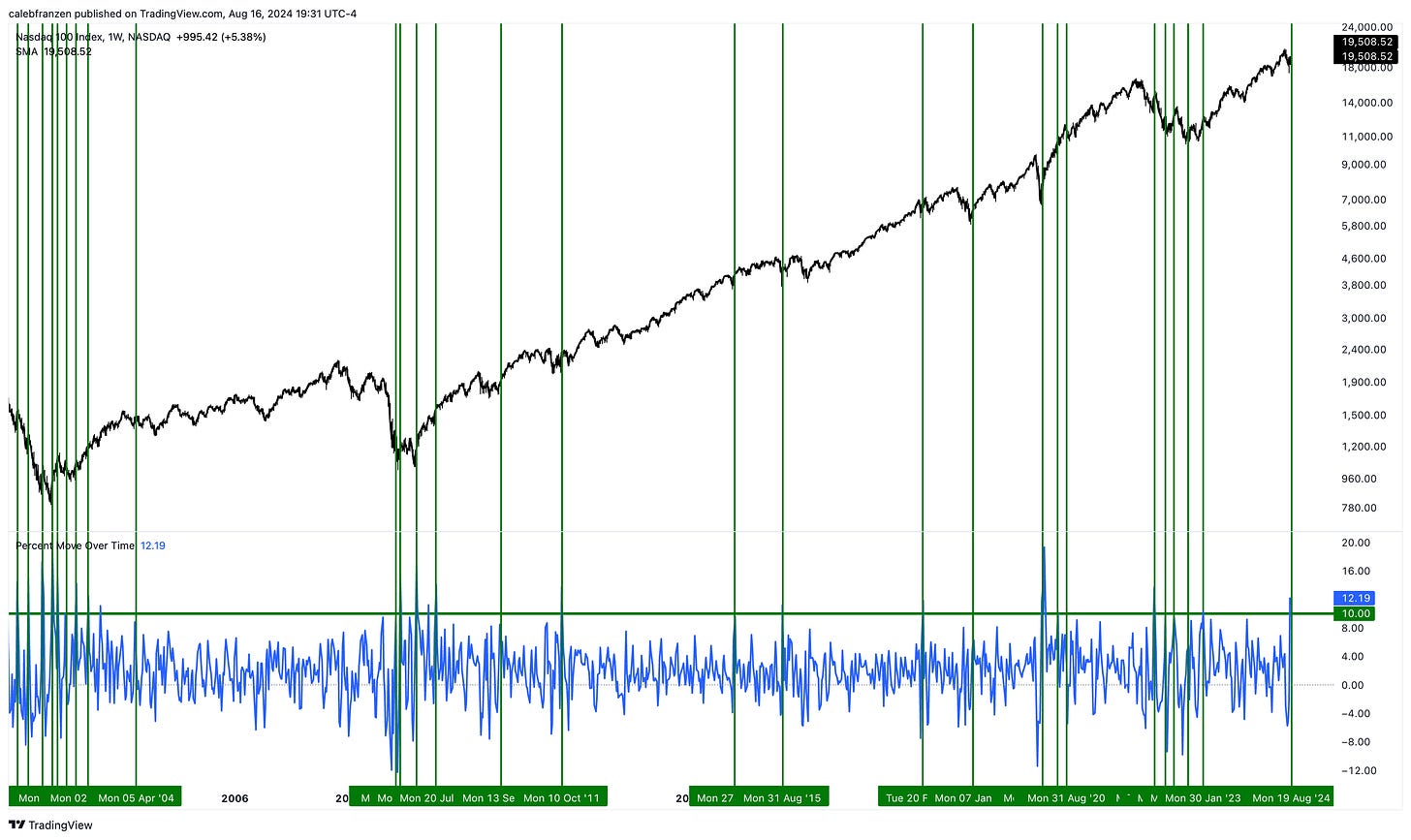

Given the magnitude of the momentum thrust off of the August 5th lows, which was 9 trading days from the close on August 16th, I was curious to know what the historical precedence was for such a rally…

Specifically, I wanted to find each time that the Nasdaq-100 gained at least +10% from the intraday lows 9 days prior, identifying similar momentum thrusts throughout history to see how the index performed after that achievement.

Going back to 2002, these are all of the 28 individual cases where this occurred:

Fundamentally, a few key aspects stand out to me right away:

This signal flashed shortly after major market bottoms in '02, '09, '20, & '22.

During downtrends, this signal typically occurs in rapid clusters and frequently flashes again within 2-6 weeks of a recent prior signal.

Additionally, one-off signals are quite rare, flashing roughly 12 months after the prior signal, but tend to occur within established uptrends during brief (but substantial) market corrections.

If I go back even further, this signal also flashed after the major market lows in 1987 and it flashed 22 times between 1990 and 2000, so it’s applicable to both bear markets and bull markets alike.

This is how the Nasdaq-100 has performed on a variety of timeframes after each of the prior 27 signals since 2002:

There is a lot of data here (which took me a long time to produce & calculate), but the implications here are crystal clear & resoundingly bullish.

These are the key highlights from the data:

Starting from 2002 through today, the average calendar year return for the Nasdaq-100 is +15%, but this indicator has an average 1Y return of +22.6%, implying that it drastically outperforms a regular buy & hold strategy.

This signal is NOT effective as a short-term bullish signal, as average 1M returns are slightly negative and only generate a positive return in 51.9% of the 28 cases. In other words, it has no edge on a 1M basis.

Negative 1M returns often occurred during those “cluster” periods during downtrends, bear markets, or even recessions, which is why weakness after 1M often generated more weakness on a 3M, 6M and even 1Y basis.

To prove this point and the importance of 1M returns, I decided to calculate what the average 1Y return was depending on the result of 1M returns. Here’s what I found out:

If 1M returns are negative (13 cases), then average 1Y returns are +11.7%.

If 1M returns are positive (14 cases), then average 1Y returns are +32.7%.

This means that 1M returns are extremely important and that investors are paid to wait and see how 1M returns evolve before making significant investment decisions. In other words, patience is rewarded. While the average 1M return is only -0.8%, the variance of returns is significant, with a range of -18% to +21.3%. Even in the case where the Nasdaq-100 gained +21.3% in the first month after the signal flashed, the total 1Y return was +63.9% (basically an additional +40% in 11 months), so investors were still paid to be patient.

3M returns were only negative in 2 of 14 cases (14%) where 1M returns were positive, which suggests that positive 1M returns often produce more strength in the months ahead. This means that it’s very rare to have additional downside volatility in the market if 1M returns are positive.

1Y returns are larger than 3M returns in 27 of 28 cases (96.4% of the time), which implies that returns from month 4 through month 12 are extremely strong.

With an average 5Y return of +104.3% and a 94.7% positivity rate, this means that investors who bought & hold after this signal flashed doubled their money in 5 years, on average.

All together, I was extremely impressed by this data & the implications.

The signal is rare, but it tends to flash several times when it does occur, which indicates that short-term returns are volatile. For long-term investors, any weakness in the market over the short-term has provided them with great buying opportunities, even if those purchases felt scary or too risky in the moment.

As such, due to my fundamental bullish stance on U.S. equities, which I reiterated in a post on X earlier this week, this study provides additional confidence that market corrections and higher volatility should be purchased. This study also pairs nicely with a variety of studies that I’ve created in recent months as well as the ones that I’ve cited from other well-known & reputable analysts. Again, this simply gives me more confidence in my assessment of market conditions.

Throughout the week, we received a myriad of data which reaffirmed that disinflation is still intact and that broader economic metrics remain resilient & dynamic, notably regarding retail sales, initial unemployment claims, and consumer confidence. While certain metrics came in soft/weak, like housing starts and the Philly Fed manufacturing data, I think it’s vital to remain focused on the weight of the evidence.

When looking at the weight of the evidence, U.S. macro data continues to be resilient & dynamic, which helped to produce strong stock market returns this week in a “good news is good news” environment. This is something that I’ve been talking about with premium members of Cubic Analytics in our weekly investor calls, which I expect will persist in the weeks/months ahead. However, if “good news is good news” for asset markets, then the opposite is also true… meaning that “bad news will be bad news”.

Therefore, in order for this current momentum thrust to stay intact and produce strong 1M returns (which have significant implications for 3M, 6M and 1Y returns), economic data must come in better than expectations or in-line with expectations.

The data doesn’t need to be perfect or even strong… it just needs to be good enough to support the underlying trend in the stock market.

My belief is that it will.

Best,

Caleb Franzen,

Founder of Cubic Analytics

This was a free edition of Cubic Analytics, a publication that I write independently and send out to 10,000+ investors every Saturday. Feel free to share this post!

To support my work as an independent analyst and access even more exclusive & in-depth research on the markets, consider upgrading to a premium membership with either a monthly or annual plan using the link below:

DISCLAIMER:

This report expresses the views of the author as of the date it was published, and are subject to change without notice. The author believes that the information, data, and charts contained within this report are accurate, but cannot guarantee the accuracy of such information.

The investment thesis, security analysis, risk appetite, and time frames expressed above are strictly those of the author and are not intended to be interpreted as financial advice. As such, market views covered in this publication are not to be considered investment advice and should be regarded as information only. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security.

Each investor is responsible to conduct their own due diligence and to understand the risks associated with any information that is reviewed. The information contained herein does not constitute and shouldn’t be construed as a solicitation of advisory services. Consult a registered financial advisor and/or certified financial planner before making any investment decisions.

Please be advised that this report contains a third party paid advertisement and links to third party websites. The advertisement contained herein did not influence the market views, analysis, or commentary expressed above and Cubic Analytics maintains its independence and full control over all ideas, thoughts, and expressions above. The mention, discussion, and/or analysis of individual securities is not a solicitation or recommendation to buy, sell, or hold said security. All investments carry risks and past performance is not necessarily indicative of future results/returns.

Each investor is responsible to understand the investment risks of the market & individual securities, which is subjective and will also vary in terms of magnitude and duration.